RUSSIAN FEDERATION

Compliance Initiative

Russian Federation’s Special Economic Zones (SEZs)

New measures on the Russian Federation’s Special Economic Zones (SEZs) – Brussels, 27 October 2025

Council Regulation (EU) 2025/2033, adopted on 23 October 2025 as part of the EU’s 19th sanctions package against the Russian Federation, introduces a new category of targeted economic restrictions against the Special Economic Zones (SEZs), innovation zones and other preferential regimes of Russia.

1. Background and Objectives

In its recitals, the Council notes that these zones represent “a core element of the economic development strategy of the Russian Federation” and host enterprises involved in the production or development of dual-use goods and technologies, advanced electronic components, robotics, software, vehicles, aeronautical systems and drones that contribute directly or indirectly to Russia’s war effort.

The aim of the European Union is therefore to limit foreign investments and financial flows of goods and technologies that could strengthen Russia’s industrial, technological and military capacities, and to reduce the risk of circumvention of existing sanctions through preferential regimes.

2. Scope and Main Prohibitions

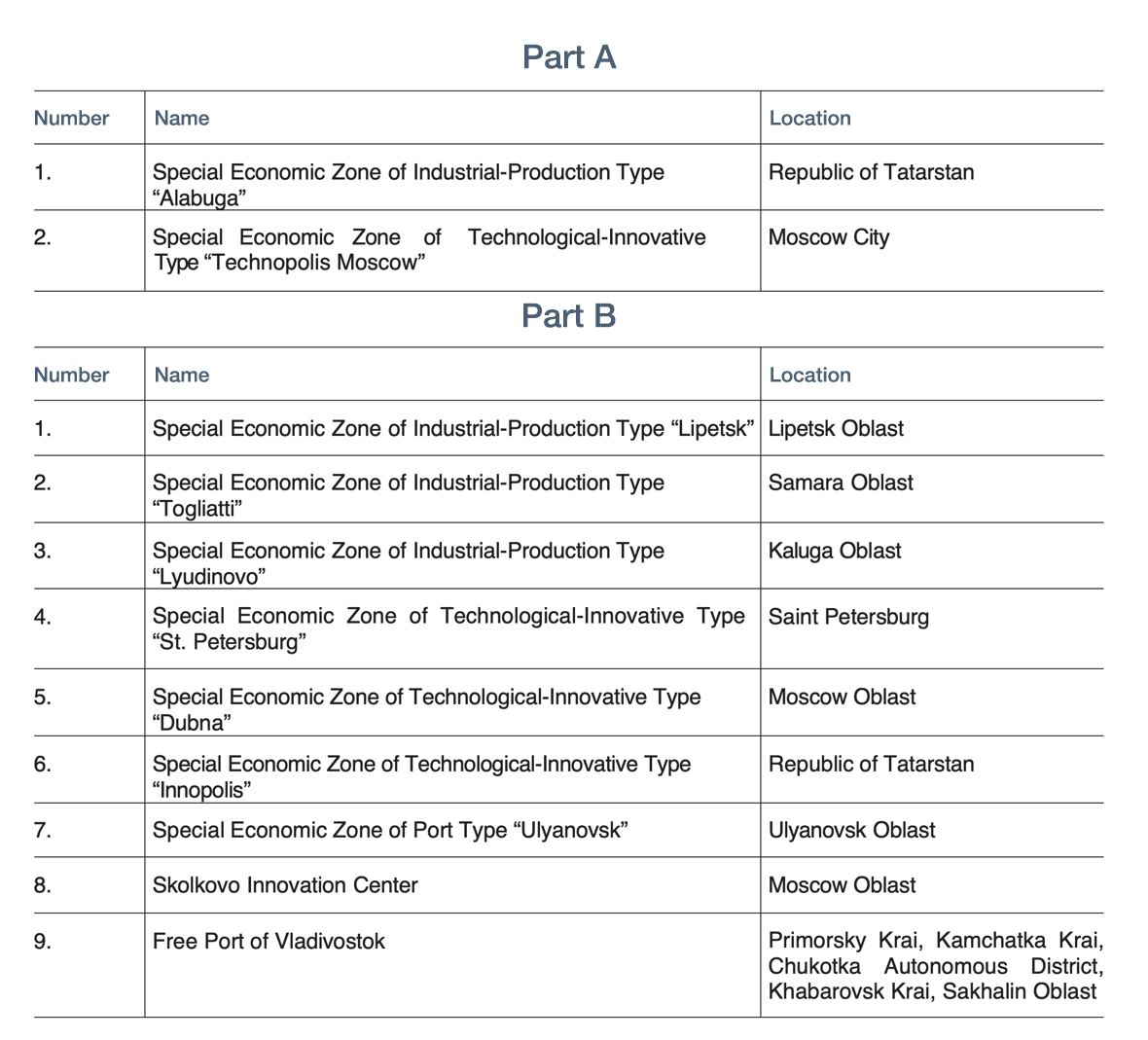

The list of special, preferential and innovation zones is contained in the new Annex LII (Part A and Part B). Article 5-bis nonies of the Regulation establishes the following prohibitions:

- Prohibition of participation in the creation of new companies or joint ventures established in, or operating through, Russian special economic zones or other preferential regimes.

- Prohibition of granting direct or indirect financing or investment in favour of enterprises operating in such zones.

- Prohibition of concluding new contracts for the supply of goods or services, or related intellectual property rights or trade secrets, or maintaining existing contractual relations with such enterprises or for use within the listed special, preferential or innovation zones (Annex LII, Parts A or B).

As of 25 January 2026, it will be prohibited to maintain shareholdings, representative offices, or contracts or agreements for the supply of goods or services, or related intellectual property rights or trade secrets, with any legal person, entity or body formally registered as a resident of the Russian Federation’s special, preferential or innovation zones listed in Annex LII, Part A.

3. Application and Affected Zones

These measures apply to all operators of the European Union, as well as any natural or legal person subject to the jurisdiction of a Member State, and also to non-EU entities when a territorial or legal link with the Union can be identified (e.g., euro payments, use of EU technology, involvement of EU personnel or subsidiaries).

The Regulation refers to:

- Industrial or production-type SEZs established under Russian federal laws (e.g., Laws No. 116-FZ, 244-FZ, 212-FZ, 193-FZ);

- Innovation and advanced technology regimes (e.g., Skolkovo, Innopolis, Dubna, Alabuga);

- Preferential regimes located in the Far Eastern and Arctic federal districts of Russia, connected with strategic sectors such as shipbuilding, mining, petrochemicals and energy.

4. Coordination with Other Sanctions Instruments

The SEZ measures complement existing prohibitions concerning exports of dual-use goods, financial restrictions, and investment bans in the energy and mining sectors. According to the European Commission’s official communication, these measures 'target special economic zones and entities that profit from Russia’s war of aggression against Ukraine.'

5. Practical Implications for EU Operators

EU companies must refrain from any:

-

investment, loan, or financial participation in enterprises established in SEZs or preferential regimes;

-

from concluding or continuing commercial, technical or supply contracts;

-

from maintaining shareholdings, joint ventures or research partnerships with entities operating in such zones.

The risk of indirect violation is significant, as many Russian companies conceal their actual operating base through shell companies registered in SEZs or 'technoparks' with neutral designations.

6. Circumvention Risk

Special Economic Zones offer tax and customs advantages that are often exploited to channel foreign investments and bypass existing restrictions. For this reason, the Regulation extends the prohibition also to companies 'operating through' such zones, even if their registered office is located elsewhere.

7. Derogations and Transitional Provisions

Specific authorisations or 'wind-down' periods may be granted by Member States’ competent authorities to allow the orderly termination of existing contracts or to ensure legal certainty. Operators must verify the validity of such derogations on a case-by-case basis.

Competent authorities may authorize:

- humanitarian activities;

- research, development or production of pharmaceutical, medical, agricultural or food products (including wheat and fertilisers);

- access to judicial, administrative or arbitration proceedings within a Member State;

- divestment or withdrawal from Russia;

- the provision of electronic communication services by EU telecommunications operators.

8. Enhanced Due Diligence and Screening Obligations

Operators must:

- verify whether their commercial or financial partners are established in or operate within a restricted zone;

- review existing contracts and participations, including the end-use of goods and technologies;

- document the results of compliance checks;

- ensure subsidiaries, intermediaries and contractors adhere to the same restrictions.

9. Penalties for Non-Compliance

Violations of the Regulation entail administrative and criminal penalties under national implementing laws, as well as reputational consequences, loss of access to banking services, and withdrawal of business authorisations.

10. Assistance and Liaison with Authorities

In cases of doubt regarding the applicability of restrictions or the identification of a SEZ, it is recommended to consult a professional specialised in international sanctions and to contact the competent national authority (e.g., Ministry of Economy or Foreign Affairs) for official clarification or specific authorisations.

COMPLIANCE NOTE

- Create and maintain an updated database of Russian SEZs and preferential regimes identified by the Regulation.

- Verify, before any new contractual relationship, whether partners or subsidiaries operate within such zones.

- Conduct retrospective reviews to detect potential indirect exposure.

- Include contractual guarantees and representations stating that the parties are not established in or operating through a restricted SEZ under Regulation 2025/2033.

- Require immediate notification of any change in partner status.

- Consider termination or suspension of existing contracts in case of confirmed risk.

- Subject compliance systems to independent audits (internal or external).